Stop by booth 320 to discuss how our solutions and expertise simplify flood, title, closing and valuation services, and help you differentiate your offering. Fill out the form to schedule an in-conference or virtual demo.

Schedule a meeting

During X26, Liz Green, senior vice president, valuation solutions, ServiceLink, will join Ronyelle Banks, director, product management, ICE, and Daniel Miller, to offer practical insights on the new UAD 3.6 updates. Mark your calendar for this impactful session!

No lengthy onboarding process; no back-and-forth. Whether you're an existing client or want to give us a try, you can access our solutions in seconds simply by adding ServiceLink as a provider in Encompass

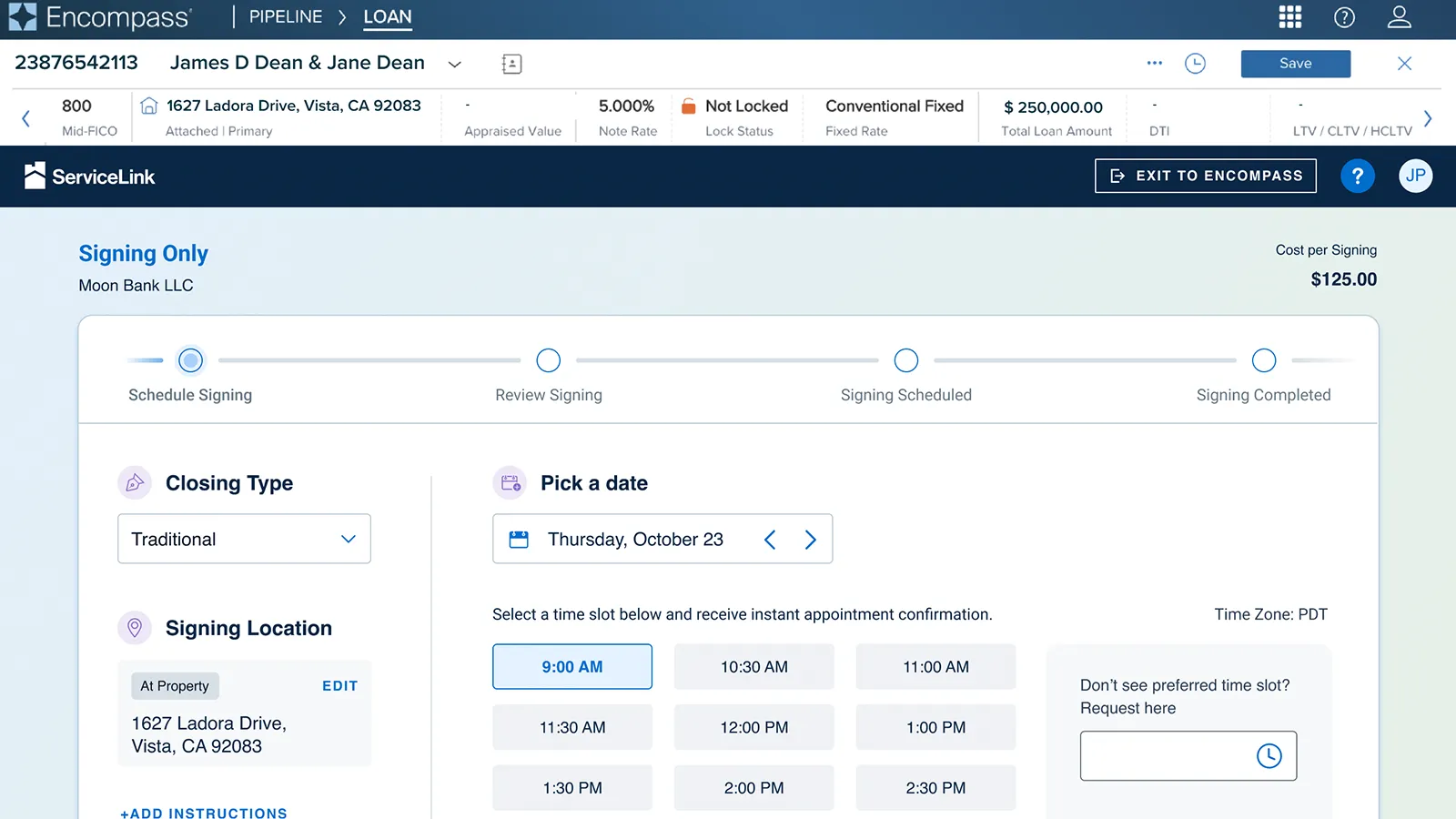

Schedule appointments instantly with our national network of experienced agents and appraisers. You and your borrower will receive instant confirmation, including details about the appraiser or signing agent. Proactive information about title complexity and timelines lets you deliver clear closing timeframe expectations early in the process.

Proactive information about title complexity and timelines lets you deliver clear closing timeframe expectations early in the process.

Receive status and progress updates within Encompass and directly. You and your borrower will receive proactive updates at key milestones. Your borrower will even get notified when the signing agent or appraiser is on their way.

Our solution has the options you and your borrowers need. Order just title, just closing services or both; opt to close in-person or virtually; schedule the closing yourself or empower your borrowers to do so.

Our flood integration streamlines ordering by offering automatic ordering of flood zone determinations based on lender-set milestones and default ordering options. Submit disputes, upload documents and access servicing transfers – all in Encompass.

Your custom configurations will flow seamlessly into the new integration after easy set up. Access to the same great services - plus an enhanced user experience, additional automation and instant scheduling.

Set up is easy: in just one click, you'll have access to title and closing or valuation solutions that will help you close faster and deliver a better borrower experience

New features in the title and close integration resulted from real-time client insights and the maturation of the integration.

Ying Wang, vice president, product design, explains why it is in lenders' best interest to work with vendors prepared for the ICE Mortgage Technology® transition deadline and how ServiceLink's EPC readiness is helping to lead the way.

Sr. Title Manager, CompanyName

Pellentesque non magna eget ex lobortis finibus. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Sr. Title Manager, CompanyName

Pellentesque non magna eget ex lobortis finibus. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Sr. Title Manager, CompanyName

Pellentesque non magna eget ex lobortis finibus. Lorem ipsum dolor sit amet, consectetur adipiscing elit.